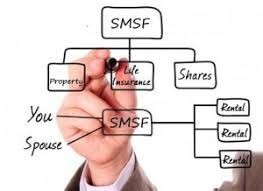

The CGT Retirement Exemption Concession: A Major Advantage for Small Business Owners

If you’re running a small business and decide to sell it – or dispose of some of its assets – the Capital Gains Tax (CGT) retirement exemption can be a game-changer. This concession can significantly reduce, or even eliminate, the tax payable on the capital gain.

Read more